If you are holding an active insurance license in both Life & Health or Property Casualty, you know that meeting CE requirements, on time and correctly, is a non-negotiable part of staying licensed and compliant. That is where Success CE stands out. Here is why many agents use Success CE to renew their Life and Health and Property Casualty licenses:

Nationwide Approval & Wide-Ranging Course Catalog

- Success CE’s courses are approved in all 50 states, covering both Life & Health and Property Casualty CE requirements. (Success CE)

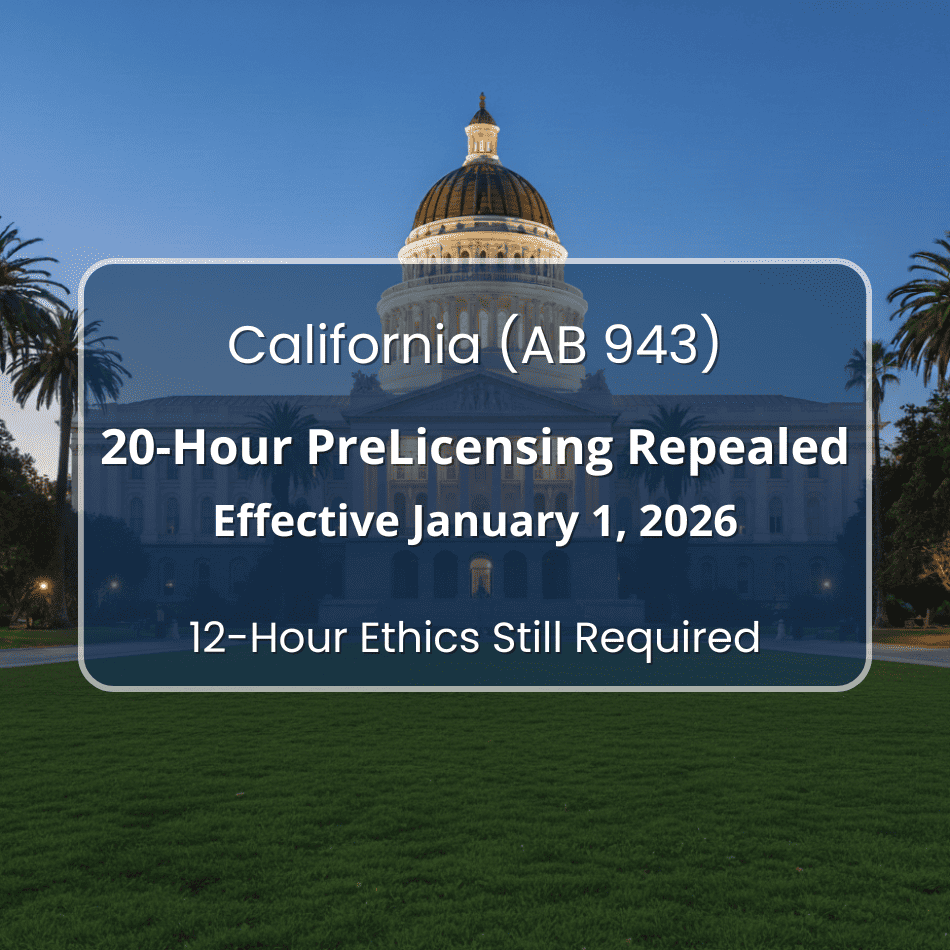

- Our catalog is not limited to basic CE: we offer courses in ethics, annuities, long-term care, and more allowing you to fulfill specialized requirements specific to your license type or state. (Success CE).

- For agents holding licenses in multiple lines (e.g., Life & Health and P&C), this breadth simplifies compliance: you do not need to piece together CE hours from different providers or juggle multiple platforms.

Efficiency – Fast, Easy, and Convenient

- We at Success CE emphasizes user convenience: our CE courses are “easy-to-complete,” and they offer same-day real-time reporting of completed credits. (Success CE)

- For busy agents who do not want to spend extra time traveling to in-person classes or coordinating schedules especially those balancing Life & Health and P&C CE hours this convenience can save significant time and stress. (Success CE)

- Our system allows for both online/self-study CE and live classroom/webinar CE (through a sister service) depending on what your state license renewal requires or which format you prefer. (insurancecontinuingeducation.com)

Cost-Effective – Competitive Pricing and Value

- Success CE has a “Guaranteed Lowest Price” for their CE courses. (Success CE)

- Given the ability to cover multiple license lines, specialized topics, and potentially bundle CE with other designations or certifications (CFP, CLU/ChFC, etc.), using Success CE may offer good value compared with juggling separate providers for each license line. (Success CE)

Good Reputation & Customer Experience

- Customer testimonials highlighted on our site praise the ease of navigation, helpful customer service, and a simple CE process. (Success CE)

- Additionally, agents report being able to complete CE quickly and renew licenses without the delays or hassles sometimes associated with other CE providers. (Success CE)

- If you have ever had CE renewal frustration (especially juggling multiple license types), working with a provider that emphasizes reliability and service can make a meaningful difference.

Useful for Multi-Line License Holders – One Stop for Everything

- Agents licensed in both Life & Health and P&C benefit from a single CE source that supports both license types, simplifying their compliance process.

- Because Success CE offers a broad set of CE courses (ethics, annuities, long-term care, etc.), you can meet specialized continuing education requirements (e.g., annuity suitability, ethics) along with general CE hours all in one place. (Success CE)

- Therefore, our unified approach reduces administrative overhead and helps ensure you do not miss any required credits for either license type.

Who Benefits Most from Success CE

- Agents with multiple licenses (Life & Health and Property & Casualty ) who want to streamline their CE compliance.

- Busy professionals who prefer online/self-study CE or flexible scheduling instead of in-person classes.

- Agents looking for good value. We offer courses beyond “just the basics,” such as ethics, annuities, or long-term care.

- Agencies or firms managing multiple producers Success CE offers services for individual licensees and corporate/agency-level CE administration. (Success CE)

Final Thoughts

For licensed agents juggling multiple license lines; Life & Health Property & Casualty, compliance shouldn’t feel like a chore. Success CE offers one of the most comprehensive, flexible, and cost-effective solutions available today. Their nationwide approvals, broad course catalog, easy-to-use online system, and strong reputation for customer service make them an appealing choice if you want to simplify CE compliance and focus more on serving clients.

Why Use Success CE

The Success Family of Continuing Education Companies provides the highest quality Life/Health and Property/Casualty Insurance Continuing Education. CFP Continuing Education, CIMA Continuing Education, CPA Continuing Education, CLU/ChFC (PACE) Continuing Education, and MCLE (Legal). Continuing Education available in all 50 states in Live Insurance, Online Insurance, and Textbook Insurance formats. Learn More