Investment Advisor Representative CE

Beginning in 2022, Investment Adviser Representatives (IAR) will be subject to a requirement that broker-dealer representatives are familiar with: Continuing Education, or CE. These are courses designed to keep a financial professional up-to-date on industry developments, current regulations, and ethical standards. Trusted advisers who require the latest industry trends & maintain compliance with continuing education regulations know to look towards Success CE for guidance.

Success CE is following the latest developments and state adoptions of the NASAA IAR CE Model Rule requiring investment adviser representatives (IAR) to complete continuing education courses. Success CE offers an efficient course catalog of IAR CE courses that provide training on industry changes, guidance, rules, and updates. Firms can take advantage of our Corporate Solutions which may include admin administration/reporting, discounted rates, or insurance and professional designation continuing education credit.

Getting to know the IAR CE Requirements

At Success CE, we recognize the difficulty in understanding new continuing education requirements. NASAA’s new CE rule is no exception and we are here to help. Below are frequently asked questions we found most common among agents:

Who is required to complete the IAR CE?

All investment adviser representative (IAR) registered in a jurisdiction that adopts the model rule will be subject to its IAR CE requirements. IARs will be required to meet the IAR CE requirements of any state which the IAR is registered.

How many CE credit hours are required?

12 credit hours total – completed annually

- 6 credit hours in Ethics and Professional Responsibility

- 6 credit hours in Product and Practices

If the IAR meets the CE requirements of their resident state, will they receive reciprocity in others states that have adopted the model rule?

An IAR registered in another state, as well as registered in their resident state, will be considered in compliance if the resident state IAR CE requirements are at least stringent as the model rule and the IAR is in compliance with the resident state’s IAR CE requirements.

What will happen if an IAR does not complete the CE requirements?

If the IAR does not complete the IAR CE requirement by the annual deadline, CRD will change their IAR registration status and set it to “CE Inactive.” This status will appear in the Investment Adviser Public Disclosure (IAPD) and in BrokerCheck. The IAR will remain “CE Inactive” until they either become compliant or action is taken by the state.

Exempt from Products and Practices CE: IARs who are dually registered as broker-dealer agents and have completed their FINRA CE requirements.

For more information about NASAA Continuing Education, see the FAQs at nasaa.org

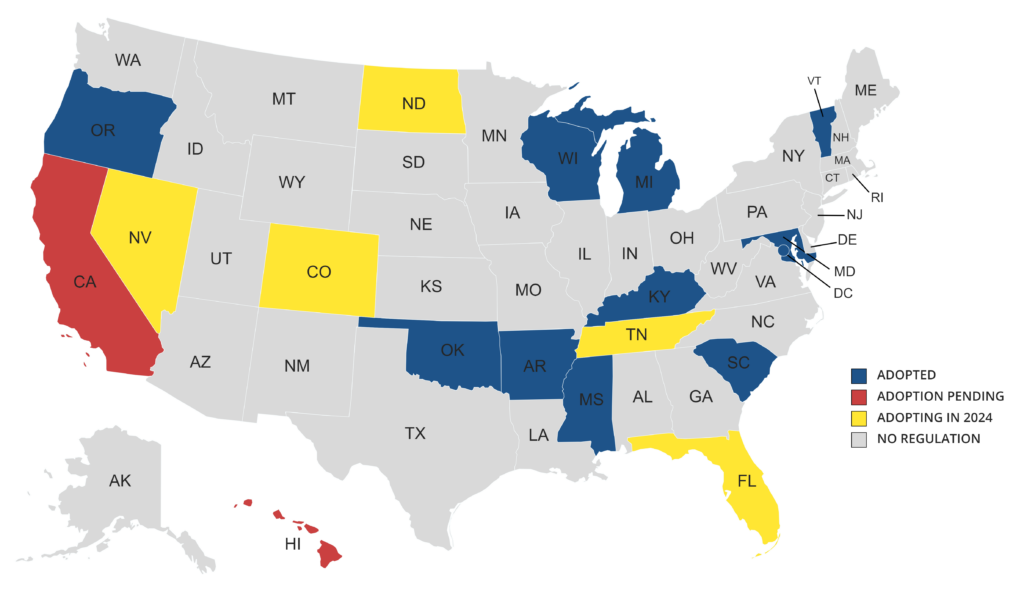

NASAA IAR CE Model Rule – State Adoption Status

| EFFECTIVE DATES: NASAA IAR CE MODEL RULE |

| Arkansas | 01/01/2023 | North Dakota | 01/01/2024 |

| Colorado | 01/01/2024 | Oklahoma | 01/01/2023 |

| Florida | 01/01/2024 | Oregon | 01/01/2023 |

| Kentucky | 01/01/2023 | South Carolina | 01/01/2023 |

| Maryland | 01/01/2022 | Tennessee | 01/01/2024 |

| Michigan | 01/01/2023 | Vermont | 01/01/2022 |

| Mississippi | 01/01/2022 | Washington, D.C. | 01/01/2023 |

| Nevada | 01/01/2024 | Wisconsin | 01/01/2023 |

- As an NASAA approved Continuing Education provider, Success CE will be introducing its CE courses soon.

- Get updates about Success CE courses by joining our email list.

NASAA does not endorse any particular provider of CE courses. The content of the course and any views expressed are my/our own and do not necessarily reflect the views of NASAA or any of its member jurisdictions.