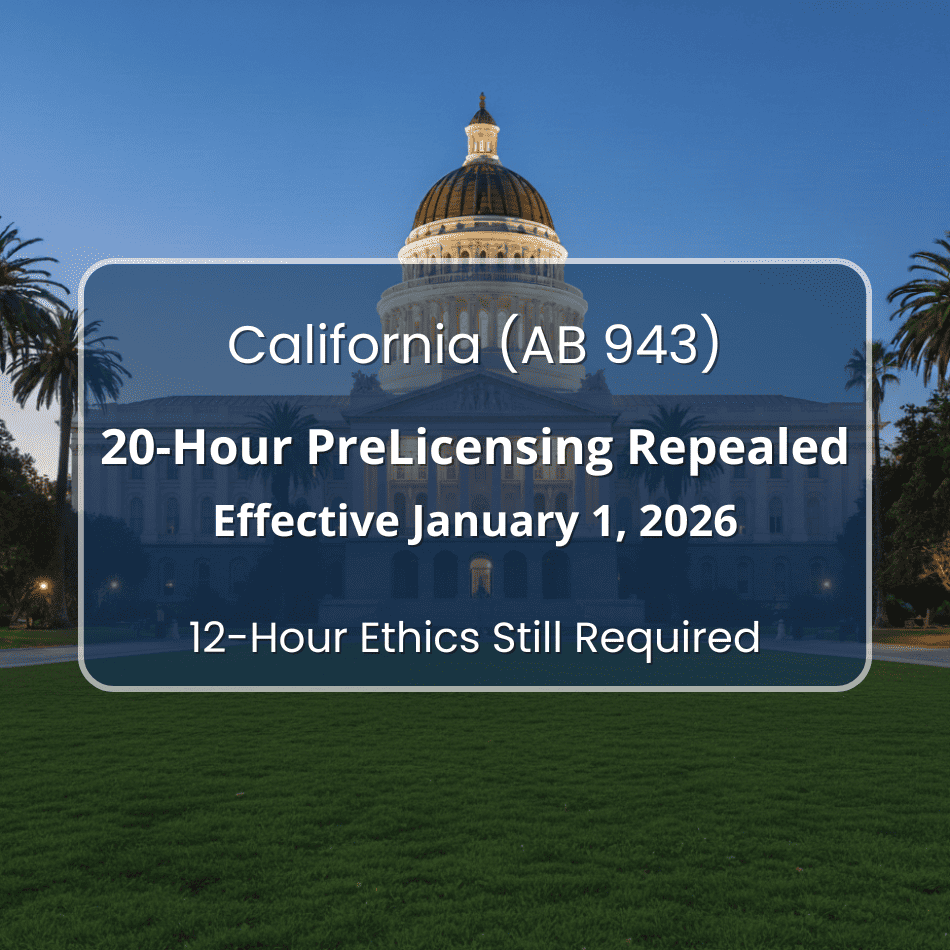

Effective January 1, 2026, CDI will officially eliminate the long-standing California 20-hour prelicensing education requirement for insurance producers.

This major regulatory update, established under AB 943 (Chapter 566, Statutes of 2025), reshapes the path to licensure for new agents across Life, Health, Property, Casualty, Personal Lines, Commercial Lines, and Limited Lines Automobile.

However, one part of the process does not change:

All applicants must still complete the mandatory 12-Hour Ethics & California Insurance Code course and pass the full state licensing exam.

This Ultimate Guide provides the most complete and authoritative breakdown of what is changing, what is staying the same, and how California insurance candidates and agencies should prepare for 2026 and beyond.

Table of Contents

- What AB 943 Means for California Insurance Licensing in 2026

- Key Changes at a Glance (Quick Summary for 2026)

- Why California Removed the 20-Hour Prelicensing Requirement

- What the California 20-hour pre-licensing repeal changes on January 1, 2026

- What Requirements Stay the Same for California Licensing

- How to Get Your California Insurance License in 2026 (Step-by-Step)

- How the California 20-hour pre-licensing repeal affects Life & Accident & Health

- 2026 Transition Timeline: What Happens to Old Courses

- California Prelicensing Requirements: 2025 vs. 2026 Comparison

- Frequently Asked Questions About the 2026 Prelicensing Changes

- What These Changes Mean for Agencies, Carriers, and Hiring Managers

- How New Applicants Should Prepare for Licensing in 2026

- Final Thoughts and Next Steps for California Insurance Applicants

1. What AB 943 Means for California Insurance Licensing in 2026

Assembly Bill 943, signed into law on October 10, 2025, updates California Insurance Code §1749 and directly removes the 20-hour line-specific prelicensing education blocks for all major insurance producer licensing types.

Beginning January 1, 2026:

- The 20-hour prelicensing requirement is fully repealed.

- The 12-Hour Ethics & California Insurance Code requirement remains mandatory.

- The state licensing exam continues for every line of authority.

- Fingerprinting remains required after exam passage.

Existing 20-hour, 32-hour, and 52-hour courses will be removed from CDI’s public course search on January 1, 2026, and inactivated January 12, 2026.

2. Key Changes at a Glance (Quick Summary for 2026)

| Requirement | Status in 2026 | Notes |

|---|---|---|

| 20-Hour Prelicensing | Repealed | Eliminated by AB 943 |

| 12-Hour Ethics & California Insurance Code | Required | Must be completed by all producer applicants |

| State Licensing Exam | Required | Unchanged requirement |

| Fingerprinting | Required | Must occur after passing the exam |

| Applies To | Life, A&H, Property, Casualty, Personal Lines, Commercial Lines, Limited Lines Auto | |

| Not Affected | Bail agents; public adjusters | Their 20-hour requirement remains |

These changes come directly from CDI’s November 2025 notice and AB 943 implementation guidance.

3. Why California Removed the 20-Hour Prelicensing Requirement

California modernized its licensing pathway to:

- Remove barriers to entry for new producers

- Streamline the licensing timeline

- Prioritize competency through Ethics & Code and exam performance

- Align with evolving national standards for producer onboarding

The Legislature determined that the 12-Hour Ethics requirement + the state exam serve as adequate competency benchmarks without the need for additional 20-hour blocks.

4. What the California 20-hour pre-licensing repeal changes on January 1, 2026

A. The California 20-Hour Prelicensing Courses Are No Longer Required

CDI will no longer recognize or display the following course types:

- 20-Hour line-specific courses

- 32-Hour (20 + 12 Ethics) blended courses

- 52-Hour (two lines + Ethics) courses

- Life

- Accident & Health or Sickness

- Property

- Casualty

- Commercial Lines

- Personal Lines

- Limited Lines Automobile

These are removed from public catalog on January 1, 2026 and inactivated on January 12, 2026.

Applies to applicants seeking:

- Life

- Accident & Health or Sickness

- Property

- Casualty

- Commercial Lines

- Personal Lines

- Limited Lines Automobile

5. What Requirements Stay the Same for California Licensing

A. 12-Hour Ethics & California Insurance Code Requirement

All new resident producer applicants must continue to complete the state-mandated:

12 hours of Ethics and California Insurance Code training

(includes the 1-hour antifraud component required since 2023)

B. State Licensing Exam Remains Mandatory

Applicants must still:

- Study the official License Examination Objectives

- Register with PSI

- Pass the exam for each selected line of authority

C. Fingerprinting & Application Sequence

Fingerprinting must be completed after passing the exam, before the license is issued.

D. No Change for Bail Agents or Public Adjusters

Their 20-hour requirement remains fully intact.

6. How to Get Your California Insurance License in 2026 (Step-by-Step)

Beginning January 1, 2026, your licensing process becomes more streamlined. Here is the updated path:

Step 1: Choose your line(s) of authority

- Life

- Accident & Health or Sickness

- Property

- Casualty

- Personal Lines

- Commercial Lines

- Limited Lines Auto

Step 2: Complete the 12-Hour Ethics & Code Prelicensing Course

This is now the only educational requirement prior to the exam.

Step 3: Prepare for the State Exam

Use the CDI exam objectives and reputable exam prep solutions.

Step 4: Pass the State Licensing Exam

You must still pass the full exam for each line.

Step 5: Get Fingerprinted & Submit Your Application

Your exam pass is valid only after fingerprint clearance and application submission. These steps come directly from CDI’s 2026 licensing guidance.

7. How the California 20-hour pre-licensing repeal affects Life & Accident & Health

Life & Accident & Health

- 20-Hour Life and 20-Hour A&H courses repealed

- Only 12-Hour Ethics & Code required

- Must pass the Life and/or A&H state exam(s)

Property & Casualty

- 20-Hour Property and 20-Hour Casualty repealed

- Combined P&C previously required 40 hours + Ethics; now only Ethics is required

- Must pass the P&C exams

Personal Lines, Commercial Lines, and Limited Lines Auto

- All 20-hour prelicensing blocks eliminated

- Ethics still required

- State exam still required

Unaffected License Types

- Bail agents

- Public insurance adjusters

These continue to require 20 hours of education.

8. 2026 Transition Timeline: What Happens to Old Courses

Through December 31, 2025

Providers may continue delivering all previously approved courses.

Rosters must be uploaded within 10 days of completion.

January 1, 2026

CDI removes 20-hour, 32-hour, and 52-hour courses from its online catalog.

January 1-11, 2026

Providers may continue uploading rosters for 2025 completions.

January 12, 2026

CDI officially inactivates all 20/32/52-hour courses.

No further roster uploads will be accepted.

9. California 20-hour Prelicensing Requirements: 2025 vs. 2026 Comparison

| License Type | Before January 1, 2026 | After January 1, 2026 |

|---|---|---|

| Life | 20 Hours + 12 Ethics | 12 Ethics only |

| Accident & Health | 20 Hours + 12 Ethics | 12 Ethics only |

| Property | 20 Hours + 12 Ethics | 12 Ethics only |

| Casualty | 20 Hours + 12 Ethics | 12 Ethics only |

| P&C Combined | 40 Hours + 12 Ethics | 12 Ethics only |

| Personal Lines | 20 Hours + 12 Ethics | 12 Ethics only |

| Commercial Lines | 20 Hours + 12 Ethics | 12 Ethics only |

| Limited Lines Auto | 20 Hours + 12 Ethics | 12 Ethics only |

| Bail Agents | 20 Hours | 20 Hours (unchanged) |

| Public Adjusters | 20 Hours | 20 Hours (unchanged) |

10. Frequently Asked Questions About the 2026 Prelicensing Changes

It was repealed under AB 943, effective January 1, 2026.

Yes. All applicants must complete the 12-Hour Ethics & California Insurance Code course.

Yes. The exam remains fully mandatory for all lines.

They will be removed from CDI’s public course search on January 1, 2026, and officially inactivated on January 12, 2026.

No. Their 20-hour requirement remains unchanged.

Yes. Fingerprinting is required after exam passage and before licensure.

11. What These Changes Mean for Agencies, Carriers, and Hiring Managers

This regulatory shift impacts hiring pipelines, onboarding workflows, and internal training expectations.

Key impacts:

- Faster onboarding for new hires

- Reduced friction for prospective producers

- More emphasis on exam preparation

- Agencies must update internal documentation

- Strict Ethics compliance remains essential

- Vendors and carriers must update LMS workflows and contracts

The Ethics requirement becomes the single standardized prelicensing education component, placing more weight on selecting a reputable provider.

12. How New Applicants Should Prepare for Licensing in 2026

A. Enroll in the 12-Hour Ethics & Code Course

Since this requirement does not change, completing Ethics early ensures you are exam-ready as soon as the new rules take effect.

B. Begin Exam Preparation

Use resources aligned with CDI’s License Examination Objectives.

C. Monitor CDI updates

CDI may release additional guidance as January approaches.

D. Start the fingerprinting process immediately after passing your exam

13. Final Thoughts and Next Steps for California Insurance Applicants

California’s adoption of AB 943 marks the largest modernization of producer licensing in decades.

By removing the 20-hour prelicensing blocks while preserving Ethics education and exam rigor, the state has created a streamlined pathway that benefits both applicants and agencies.

In 2026 and beyond, your required steps are simple:

- Complete the 12-Hour Ethics & California Insurance Code course

- Prepare for and pass the state licensing exam

- Get fingerprinted and submit your application

Success CE is ready to support candidates and agencies with approved Ethics training and comprehensive prelicensing preparation.

For official updates, visit the California Department of Insurance.

Learn More About Success Prelicensing, powered by Success CE, Inc.

Start the required 12-Hour Ethics & California Insurance Code course today!

Your licensing journey begins here.