Success CE Blog

- Why you Should Use Success CE to Renew Your Life and Health and Property Casualty Licenses.

- SuccessPreLicensing.com – A Success CE Company Transforming Insurance & Securities Exam Prep

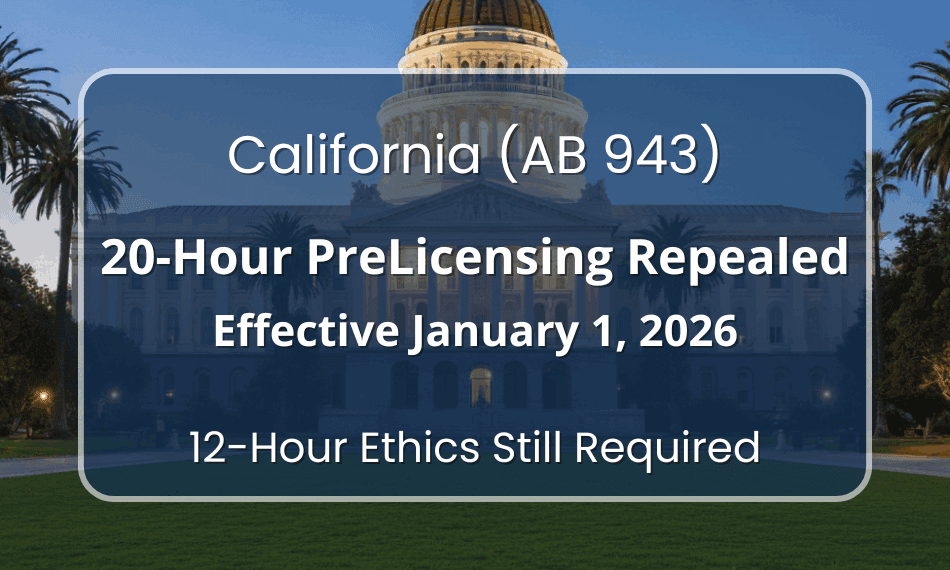

- California Repeals 20-Hour Insurance Prelicensing (AB 943) – 2026 Licensing Guide

- Key Insurance Regulatory Updates in 2025

- P&C Insurance in a Warming World

- How Insurance Agents Can Use AI to Generate Sales

- New CE Requirement: Variable Life Insurance Policies

- New CA Four-Hour Life Insurance CE Course

- 5 Tips for Selling Life Insurance in the Summer

- 5 Tips for Starting Your Career in Life Insurance

- How Market Volatility is Reshaping Annuity Sales

- What the Trump Administration Means for the Insurance Industry

- California’s New 8-Hour Annuity Training Requirement

- Insurance Agents: Growing Your Business Through Your Networks

- New Fraud Requirement For California Insurance Continuing Education

- The Insurance Industry in 2024: Key Changes & The Future

- CA Annuity Best Interest: Ask for the Order & Double your Sales

- How the New Federal Interest Rates Will Affect Annuities

- The Challenges of Insuring the Gig Economy

- New IAR CE Requirements for Investment Advisors

- The Everchanging Landscape of Social Security

- How to Become a Licensed Securities and Insurance Agent

- Ensuring Lifetime Income for Seniors Through Annuities

- How to Boost Attendance for Your Product Presentation

- What is the Role of a Financial Planner?

-

California’s New 8-Hour Annuity Training Requirement

The California Department of Insurance (CDI) has introduced a new 8-hour annuity training requirement aimed at enhancing consumer protection and ensuring insurance professionals are well-versed in the intricacies of annuity products. California’s new 8-Hour Annuity Training updates the state’s commitment to equipping insurance agents with the knowledge necessary to offer suitable recommendations and maintain transparency.

-

Insurance Agents: Growing Your Business Through Your Networks

In the competitive world of insurance sales, finding innovative ways to grow your business is essential. One of the most effective strategies is building and leveraging referral networks. Referrals are powerful because they are rooted in trust and personal recommendations, which can significantly shorten the sales cycle and boost client acquisition rates. Here, we explore

-

New Fraud Requirement For California Insurance Continuing Education

In an effort to bolster integrity within the insurance industry, California has introduced a new continuing education (CE) requirement focused on fraud prevention and awareness. Starting in 2024, all licensed insurance professionals in California must complete a dedicated course on insurance fraud as part of their license renewal process. This requirement comes at a time

-

The Insurance Industry in 2024: Key Changes & The Future

The insurance industry continues evolving in response to market shifts, technological advancements, and consumer demands. In 2024, the sector saw several significant developments that are reshaping its landscape. Here’s a look at the top trends and changes that have impacted the insurance industry this year: Digital Transformation Accelerated by AI and Automation Embedded Insurance and

-

How the New Federal Interest Rates Will Affect Annuities

Interest rates play a significant role in various aspects of the financial world, including annuities. Annuities, popular financial products for retirement planning, are directly impacted by fluctuations in federal interest rates set by the Federal Reserve. Whether you’re a seasoned insurance professional or someone exploring annuities for the first time, understanding how interest rate changes

-

New IAR CE Requirements for Investment Advisors

In the ever-evolving landscape of financial regulations, staying informed and compliant is crucial for professionals in the investment advisory industry. One of the latest changes impacting Investment Adviser Representatives (IARs) is the introduction of a mandatory Continuing Education (CE) requirement. This new regulation, effective as of 2022, aims to ensure that IARs maintain a high

-

How to Become a Licensed Securities and Insurance Agent

If you’re interested in pursuing a career that offers both dynamic opportunities and the chance to help individuals achieve their financial goals, becoming a licensed securities and insurance agent might be the perfect path for you. This guide will walk you through the steps to become licensed in both fields, providing you with a solid

-

Ensuring Lifetime Income for Seniors Through Annuities

As seniors approach retirement, one of their biggest concerns is ensuring a steady and reliable source of income for the rest of their lives. Annuities offer a solution by guaranteeing income regardless of market conditions. As an insurance producer you can ensure a lifetime income for seniors through various annuity products Here’s how annuities can

-

How to Boost Attendance for Your Product Presentation

Hosting a product presentation is a crucial part of launching new offerings and engaging with potential customers. However, a well-prepared presentation can fall flat if the attendance is low. Our Superior CE program is specifically designed to boost attendance of your product presentations by including a great value add, CE credit. Along with Superior CE,

-

What is the Role of a Financial Planner?

In personal finance, where every decision can influence your financial future, having a reliable navigator can make all the difference. Enter the financial planner – a professional equipped with the knowledge, expertise, and tools to guide individuals and families toward their financial goals. Learn more about the role of a financial planner, exploring why their

-

5 Tips to Ace Your Life Insurance License Exam

Are you gearing up to take your life insurance licensing exam? Congratulations on taking the first step toward a rewarding career in the insurance industry! However, it’s no secret that preparing for any licensing exam can be daunting. But fear not! With the right strategies and mindset, you can confidently tackle the exam and emerge

-

Essential Tips for Recruiting New Insurance Agents

Recruiting new insurance agents is a critical component of growing a successful insurance agency. Finding candidates who not only have the necessary skills and qualifications but also understand the unique aspects of the insurance industry can be challenging. To help you streamline your recruiting process and attract top talent, here are some specific tips tailored

-

Hiring Tips for 2024: Attracting and Retaining Top Talent

In 2024, the insurance industry continues to be highly competitive when it comes to attracting and retaining top talent. The shifting landscape, particularly in the wake of the COVID-19 pandemic, has accelerated trends such as remote work, digitization, and the emphasis on a company’s culture and values. Here are some essential hiring tips tailored for

-

Tips for Selling Insurance in an Election Year

Election years can bring about unique challenges and opportunities for insurance professionals as the political landscape evolves. Successfully selling insurance during this period requires a strategic approach that considers the uncertainties and changes that may arise. Here are some valuable tips to navigate the complexities and make the most out of selling insurance in an

-

5 Tips for a New Insurance Agent

Starting a career as an insurance agent can be both exciting and challenging. Whether you’re new to the industry or transitioning from another field, here are five valuable tips to help you kickstart your journey as a successful insurance professional. 1. Invest in Continuous Learning The insurance industry is dynamic and ever-evolving. To stay ahead

-

How AI is Transforming The Insurance Industry

In recent years, the insurance industry has undergone a profound transformation, thanks to the advent of Artificial Intelligence (AI). As an insurance professional, understanding the implications of AI is crucial in staying ahead in this dynamic landscape. In this blog, we’ll explore the various ways AI is influencing and reshaping the insurance sector. Enhanced Customer

-

Emerging Insurance Trends in 2024

In the ever-evolving landscape of the insurance industry, staying ahead of the curve is essential for professionals and newcomers alike. As we step into 2024, several trends are shaping the future of insurance. Here we will explore these emerging dynamics that are impacting the industry. Technological Advancements Technology continues to be a driving force in

-

Is the End of the Year a Good Time to Sell Life Insurance?

As the year winds down, insurance professionals have a golden opportunity to strategically sell life insurance. Here we will explore the significance of your client’s year-end reflections and financial planning. We’ll also explore how the end of the year is the optimal time to discuss and sell life insurance solutions. Year-End Reflections and Financial Assessments

-

5 Reasons to become a Certified Financial Planner

Becoming a Certified Financial Planner (CFP) is a significant step in one’s career within the financial services industry. Whether you’re a seasoned professional in the insurance business or someone just starting out, obtaining CFP certification can open up new avenues for personal and professional growth. The designation is not only a testament to your commitment

-

What is the Role of an Insurance Claims Adjuster?

Navigating the intricate landscape of insurance involves understanding the diverse roles that shape the industry. Among these, the position of an insurance claims adjuster is both pivotal and transformative. Whether you find yourself well-versed in the nuances of insurance or are just embarking on your journey in the field, it is imperative to understand a

-

The History of Insurance Regulation

In the United States, the government plays a pivotal role in regulating the insurance industry. Federal and state governments have the responsibility to ensure fair practices, protecting consumers, and maintaining stability within the industry. However, the government was not always involved in the insurance business. Today we will discuss the long and intricate history of

-

What You Need to Know to Kickstart Your Insurance Career

If you’re considering a career in insurance sales, you’re on the right track to a rewarding profession. However, before you can hit the ground running, you’ll need to navigate the intricate path of licensing requirements. In this guide, we’ll walk you through the essential steps, key skills, and specific state requirements you need to fulfill

-

The Ins and Outs of Property and Casualty Insurance

In the ever-evolving landscape of insurance, one area that demands meticulous attention and understanding is Property and Casualty Insurance. This branch of insurance is essential for both individuals and businesses, offering protection against various risks associated with property, liability, and legal responsibilities. In this article, we will unravel the intricacies of property and casualty insurance,

-

Embracing Change: Life Insurance Trends in 2023

In an ever-changing world, the life insurance industry is not immune to evolving trends. As we navigate through 2023, several notable shifts have emerged, reshaping the way individuals and families approach life insurance. From innovative technologies to changing customer expectations, this article explores the key life insurance trends in 2023 defining the industry landscape this

-

Annuities: A Comprehensive Guide to an Important Financial Tool

Annuity Advantages Annuities play a pivotal role in modern financial planning, offering a multitude of advantages over other types of investments. Foremost, they provide a foundation of income security during retirement that allows retirees to maintain their lifestyle and cover essential expenses without the concern of outliving their savings. Beyond this, annuities offer a powerful

-

CRM Tips for Insurance Producers

As an insurance producer, staying ahead in a competitive market requires more than just industry knowledge and sales skills. In today’s digital age, effectively utilizing Customer Relationship Management (CRM) software can make all the difference in your business. CRM software can boost productivity, enhance customer interactions, and ultimately, drive higher sales. Here, we’ll reveal four

-

How the Internet is Reshaping Insurance Sales

In today’s fast-paced and interconnected world, the internet has become an indispensable tool for businesses across various industries. One sector that has significantly benefited from the digital revolution is the insurance industry. With its vast reach and ability to connect businesses with consumers, the internet has revolutionized insurance sales, transforming the way policies are marketed,

-

The LTC Partnership Program: Why it’s Important

Long-term care (LTC) plays a crucial role in our lives and the lives of our loved ones as we age. LTC provides support and assistance to individuals who require help with daily activities due to illness, disability, or advanced age. The LTC Partnership Program was established in response to the rising need for affordable and

-

Open New Doors with a CPA Designation in 2023

Why get a CPA Designation? In the fast-paced world of finance, trust and credibility are crucial factors that can make or break professional relationships. For those considering a career in accounting or finance, obtaining a Certified Public Accountant (CPA) designation can be a game-changer. The CPA designation not only signifies a high level of expertise

-

Selling Annuities: The Key to Unlocking Success

There are many benefits to selling annuities in today’s insurance landscape. As an insurance professional, your goal is to provide financial security and peace of mind to your clients. While you may already offer a variety of insurance products, one area worth exploring is the sale of annuities. Annuities offer a host of benefits that

-

Why you Should Use Success CE to Renew Your Life and Health and Property Casualty Licenses.

If you are holding an active insurance license in both Life & Health or Property Casualty, you know that meeting CE requirements, on time and correctly, is a non-negotiable part of staying licensed and compliant. That is where Success CE stands out. Here is why many agents use Success CE to renew their Life and

-

SuccessPreLicensing.com – A Success CE Company Transforming Insurance & Securities Exam Prep

Preparing for a state insurance license or a securities registration exam is one of the most important steps in beginning a new career. Yet for many candidates, the experience can feel overwhelming: dense textbooks, outdated practice questions, and confusing explanations that don’t reflect today’s regulatory landscape. SuccessPreLicensing.com, a Success CE company, was created to solve

-

California Repeals 20-Hour Insurance Prelicensing (AB 943) – 2026 Licensing Guide

Effective January 1, 2026, CDI will officially eliminate the long-standing California 20-hour prelicensing education requirement for insurance producers. This major regulatory update, established under AB 943 (Chapter 566, Statutes of 2025), reshapes the path to licensure for new agents across Life, Health, Property, Casualty, Personal Lines, Commercial Lines, and Limited Lines Automobile. However, one part